G. Halsey Wickser, Loan Agent Things To Know Before You Get This

Table of ContentsNot known Incorrect Statements About G. Halsey Wickser, Loan Agent The Best Strategy To Use For G. Halsey Wickser, Loan AgentThe 5-Minute Rule for G. Halsey Wickser, Loan AgentSome Known Facts About G. Halsey Wickser, Loan Agent.How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

When functioning with a mortgage broker, you need to clarify what their charge framework is early on in the process so there are no surprises on closing day. A home loan broker typically just obtains paid when a finance shuts and the funds are launched.Most of brokers do not cost customers anything up front and they are generally risk-free. You need to make use of a home mortgage broker if you intend to discover access to home mortgage that aren't easily advertised to you. If you don't have impressive credit score, if you have a distinct loaning circumstance like possessing your own service, or if you just aren't seeing home mortgages that will work for you, after that a broker may be able to get you accessibility to car loans that will be beneficial to you.

Home mortgage brokers may also be able to help funding candidates certify for a lower rate of interest rate than a lot of the commercial finances supply. Do you need a home mortgage broker? Well, working with one can save a borrower effort and time during the application process, and possibly a whole lot of money over the life of the car loan.

Getting The G. Halsey Wickser, Loan Agent To Work

A specialist mortgage broker stems, bargains, and processes residential and commercial home loan in support of the customer. Below is a 6 point overview to the solutions you should be offered and the expectations you need to have of a professional home loan broker: A home mortgage broker uses a variety of home loan from a variety of different lending institutions.

A mortgage broker represents your interests instead of the interests of a loaning institution. They need to act not only as your agent, however as an experienced specialist and problem solver - mortgage broker in california. With accessibility to a vast array of mortgage products, a broker has the ability to offer you the best value in regards to rate of interest, settlement amounts, and funding products

Many scenarios demand even more than the easy use of a thirty years, 15 year, or flexible rate home mortgage (ARM), so innovative mortgage methods and innovative remedies are the advantage of dealing with an experienced home mortgage broker. A home mortgage broker navigates the customer through any type of circumstance, handling the procedure and smoothing any type of bumps in the road in the process.

The Definitive Guide for G. Halsey Wickser, Loan Agent

Debtors who discover they need bigger fundings than their bank will certainly accept likewise gain from a broker's expertise and capability to effectively acquire funding. With a home loan broker, you only require one application, as opposed to completing types for each specific loan provider. Your home loan broker can provide a formal contrast of any kind of loans recommended, assisting you to the details that accurately represents cost differences, with current rates, factors, and closing prices for each and every finance reflected.

A trusted home mortgage broker will certainly reveal just how they are paid for their services, in addition to information the overall costs for the finance. Individualized solution is the distinguishing element when selecting a mortgage broker. You need to anticipate your home mortgage broker to aid smooth the method, be available to you, and advise you throughout the closing procedure.

The journey from dreaming concerning a brand-new home to really owning one might be full of challenges for you, particularly when it (https://6714dd2ab5571.site123.me/) concerns protecting a home loan in Dubai. If you have been presuming that going straight to your financial institution is the very best route, you may be missing out on out on a simpler and possibly a lot more helpful alternative: dealing with a mortgages broker.

9 Easy Facts About G. Halsey Wickser, Loan Agent Described

One of the considerable advantages of utilizing a home mortgage expert is the specialist financial recommendations and vital insurance policy guidance you receive. Home loan experts have a deep understanding of the numerous monetary products and can aid you choose the appropriate home mortgage insurance coverage. They ensure that you are properly covered and give advice tailored to your economic circumstance and long-lasting objectives.

This procedure can be daunting and lengthy for you. A home loan brokers take this burden off your shoulders by taking care of all the documentation and application procedures. They understand specifically what is required and make certain that whatever is finished accurately and on schedule, decreasing the threat of delays and mistakes. Time is money, and a home mortgage car loan broker can conserve you both.

This indicates you have a far better chance of finding a mortgage finance in the UAE that perfectly fits your needs, including specialized products that might not be available with conventional banking networks. Navigating the home mortgage market can be complex, particularly with the myriad of products available. A provides expert guidance, assisting you recognize the benefits and drawbacks of each alternative.

Indicators on G. Halsey Wickser, Loan Agent You Should Know

This professional recommendations is invaluable in securing a home mortgage that straightens with your financial objectives. Mortgage consultants have actually established partnerships with many loan providers, offering them considerable discussing power.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Rick Moranis Then & Now!

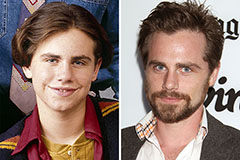

Rick Moranis Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now!